Fascination About Loans Vancouver

Table of ContentsNot known Factual Statements About Home Equity Loans Bc Second Mortgage Vancouver Can Be Fun For AnyoneAll About Home Equity Loan VancouverThe Only Guide to Home Equity Loan Vancouver

If you are incapable to pay the finance back, you may lose your house to repossession. Are Residence Equity Loans Tax Deductible? The passion paid on a residence equity funding can be tax obligation deductible if the earnings from the loan are utilized to "get, build, or significantly boost" your home - Mortgages Vancouver.Just How Much Residence Equity Funding Can I obtain? For professional borrowers, the limit of a home equity funding is the quantity that obtains the borrower to a combined loan-to-value (CLTV) of 90% or much less. This indicates the total of the balances on the home loan, any existing HELOCs, any kind of existing residence equity car loans, as well as the new house equity finance can not be even more than 90% of the evaluated worth of the house.

Can You Have a HELOC and also a Residence Equity Financing Simultaneously? Yes. You can have both a HELOC and a home equity car loan at the exact same time, offered you have enough equity in your house, along with the revenue and also credit rating to obtain authorized for both. The Base Line A residence equity funding can be a far better option economically than a HELOC for those who know specifically just how much equity they need to draw out as well as want the security of a set rates of interest.

Among the benefits of homeownership is having the ability to tap right into the equity in your home and also use it as security for a lending when cash is needed to spend for significant expenses such as residence improvements or debt consolidation. Moneyed in a round figure as well as repaid over five to thirty years at a set interest rate, house equity lendings can be a great choice for these kinds of huge cash money needs.

Unknown Facts About Loans Vancouver

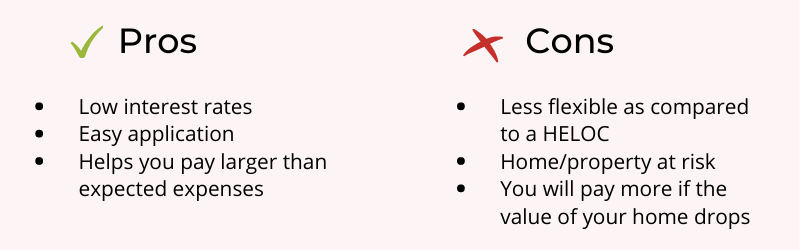

Right here are the pros and also cons of house equity loans. Secret advantages of residence equity lendings, Those that get home equity car loans may locate there are several benefits versus various other forms of borrowing.

Long payment terms, The settlement terms on home equity fundings can be as long as two decades. This fact, combined with lower rate of interest than unsecured fundings can convert right into a really budget-friendly month-to-month settlement installation. Possible tax-deductible passion, One more prospective advantage of residence equity blog here lendings is the tax obligation write-off.

Getting approved for a house equity financing generally requires having in between 15 percent to 20 percent in equity in your residential or commercial property. A home equity funding is tied to your home. If you pick to market the residence, you will certainly be called for to settle the finance."Oftentimes, you might be able to use the proceeds of your home sale to repay both car loans," states Sterling.

Facts About Foreclosure Loans Revealed

HELOCs, Both a residence equity car loan and also a home equity line of debt (HELOC) use your house as security when obtaining money. Nevertheless, there are likewise several differences in between these two financial items, making it vital to do your research and comprehend which one is genuinely appropriate for your needs and monetary photo.

On top of that, this option comes with a fixed passion price for the life of the car loan as well as taken care of month-to-month settlements, which can be a more secure wager for those on a tight budget."Home equity fundings offer you the safety of understanding your precise regular monthly repayments," says Sterling, of Georgia's Own. HELOCA HELOC is a revolving line of credit report comparable to a bank card.

You must believe thoroughly about whether you are comfortable utilizing your house as collateral prior to continuing with this type of car loan remembering that if for some factor you skip, you could lose your home.

Home Equity Loan Vancouver Fundamentals Explained

Alternatives to a residence equity funding, A residence equity lending isn't your only choice when you need money. An additional alternative to take into consideration is a home equity line of credit history (HELOC), which gives you accessibility to cash that you can touch during an established draw period. Loans Vancouver. The upside of this path is that you're not dedicating to borrowing the entire sum, so you don't automatically have to start paying interest on it.

Visualize you're looking at what you think will be a $30,000 home repair. If you take out a $30,000 residence equity finance, you'll be on the hook for interest on that whole $30,000. Nevertheless, if you secure a $30,000 HELOC, yet your fixing only winds up setting you back $25,000, you'll prevent paying rate of interest on the remaining $5,000 (thinking you don't borrow it for one more purpose).

This involves refinancing your visit here home mortgage to a new lending-- preferably, one with a lower rate of interest. However you obtain more than the amount of your impressive home mortgage balance. This way, you get the difference in cash money and make use of that money as you please. If you owe $150,000 on your home mortgage but do a cash-out re-finance, you could get a brand-new car loan worth $180,000.